Child Tax Credit 2025 Qualifications Calculator – For the 2025 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 . Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. .

Child Tax Credit 2025 Qualifications Calculator

Source : www.hrblock.com

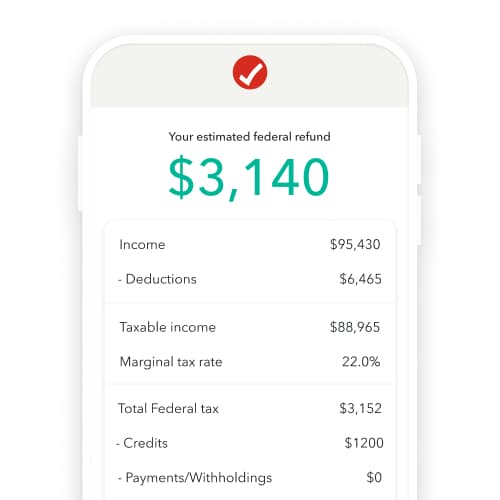

Free Tax Calculators & Money Saving Tools 2023 2025 | TurboTax

Source : turbotax.intuit.com

Health Insurance Marketplace Calculator | KFF

Source : www.kff.org

2023 and 2025 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Your First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2023 2025: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

A free IRS tax filing software is launching in 2025 — do you

Source : mashable.com

Your First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

8 ways you can save on taxes in 2025 | Principal

Source : www.principal.com

A free IRS tax filing software is launching in 2025 — but the

Source : sea.mashable.com

Child Tax Credit 2025 Qualifications Calculator Tax Calculator: Return & Refund Estimator for 2023 2025 | H&R Block®: The child tax credit and other family tax credits and deductions can have a significant impact on your tax liability and potential refund. However, the qualifications for the 2025 tax year . The new proposed child tax credit would be more modest than the pandemic-era one passed in the American Rescue Plan, though The Center on Budget and Policy Priorities says that the expansion would .